Mortgage Insurance Cover

What does mortgage insurance cover.

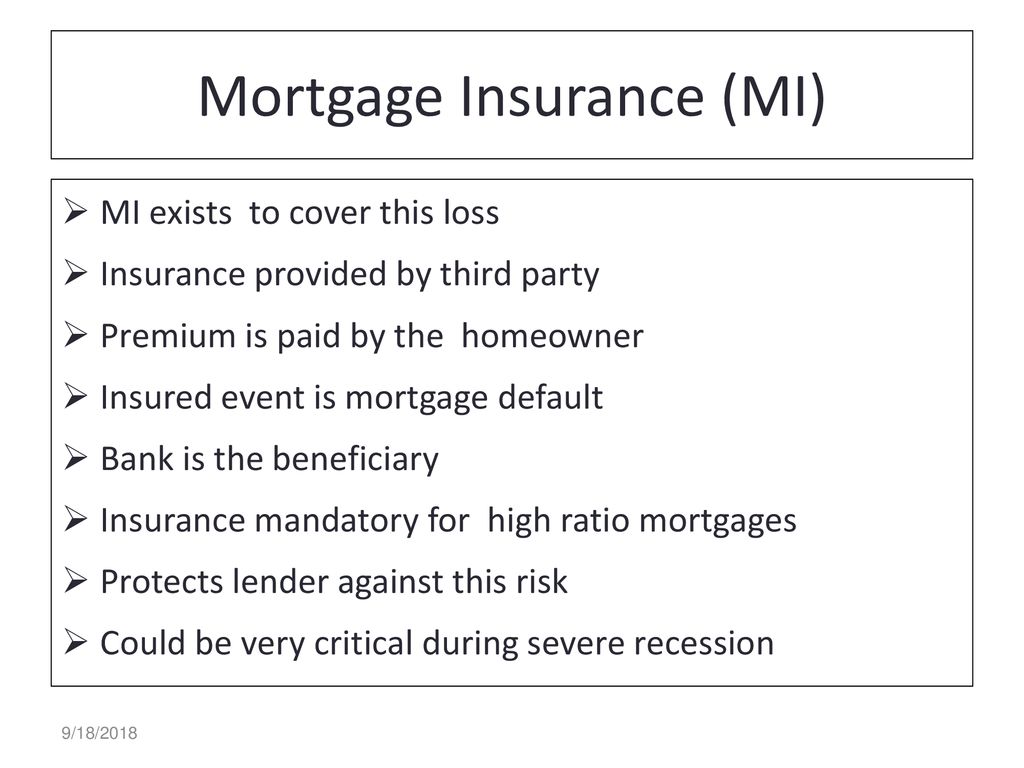

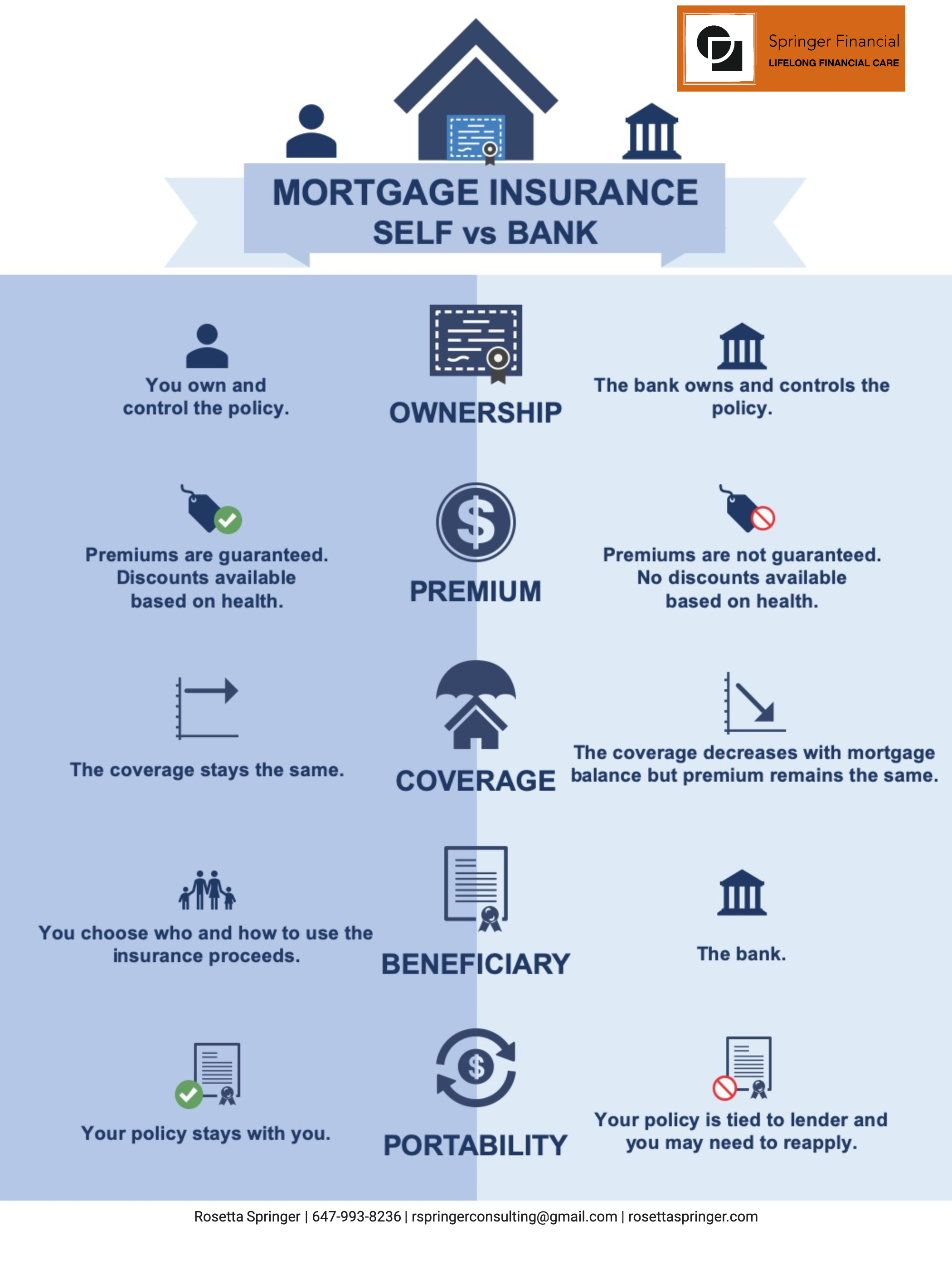

Mortgage insurance cover. What does a mortgage payment protection policy cover. Is there a difference between life insurance and mortgage life insurance. Mortgage insurance is an insurance policy that protects a mortgage lender or titleholder if the borrower defaults on payments passes away or is otherwise unable to meet the contractual. But it increases the cost of your loan.

Mortgage insurance protects the lender or the lienholder on the property in the event the borrower defaults on the loan or is otherwise unable to meet their obligation. Once the balance that you owe on your loan is less than 80 percent of the purchase price you can request that the lender terminate the insurance. Depending on the mortgage homeowners may be able to stop paying mortgage insurance at a certain point. Mortgage payment protection insurance covers the cost of your monthly mortgage repayments if you fall ill or lose your job.

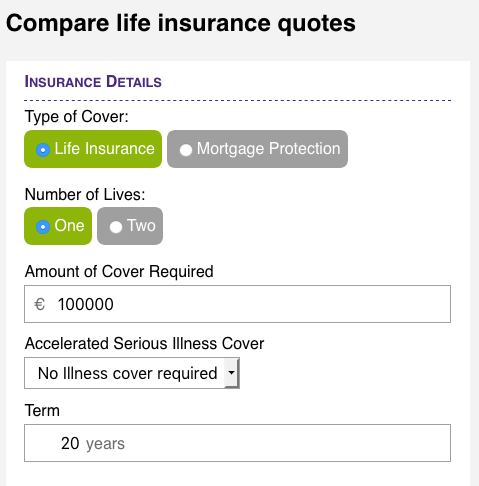

Mortgage protection insurance can cover you for the following. Typically borrowers making a down payment of less than 20 percent of the purchase price of the home will need to pay for mortgage insurance. So while its still a potentially large payout it must be used to cover the specific existing debt. Life insurance is more of a general form of cover.

The longer the length and size of the payoff the more youll likely pay for the protection. Mortgage life insurance is specifically designed to cover the remaining amount owed on a mortgage. Its highly unlikely that your mortgage insurance policy will cover you from the moment you take out the policy in fact it may be a few months before youre able to claim. Mortgage protection insurance can help your family cover your mortgage under certain circumstances you can avoid foreclosure if you can no longer work to pay your mortgage.

If you cant cover your mortgage costs because youre off work your insurer will give you money each month to help out. Mortgage insurance lowers the risk to the lender of making a loan to you so you can qualify for a loan that you might not otherwise be able to get. Most traditional mortgages require that homeowners pay for mortgage insurance for the first year after they take out a loan. What does mortgage protection cover.

If a homeowner defaults on the mortgage mortgage insurance covers them for at least a year but often longer. It comes in many forms but the beneficiary receives a payment upon your death that can be used however they wish. Lets take a closer look at what mpi is what it covers and who might need a policy. Mortgage insurance helps pay a portion or all of your mortgage if you were to die.

Unemployment cover is likely to have a longer exclusion period. The time between your policy beginning and you being able to claim is known as the exclusion period or buffer period and these can vary from 30 180 days. If you are required to pay mortgage insurance it will be included in your. Mortgage insurance also is typically required on fha and usda loans.