Life Cover For Parents

One of the primary reasons why an adult child would consider buying life insurance for a parent or parents is to cover the cost of a funeral and other final expenses.

Life cover for parents. The parent funeral plan makes it possible to cover the costs of your parents funeral. If you have a parent or parents that already have life insurance you can simply take over their payments. Today the average cost of final expenses can be approximately 10000 when adding together the cost of a burial plot headstone and a memorial service. This plan provides cover for up to two direct parents and two parents in law from as little as r75 a month.

These are called term life cover and whole life cover respectively. The life insurance could cover the remainder of payments on the house make provision for you to continue studying or pay for estate taxes if your parents are wealthy and own expensive real estate. Both the life assured and policy owner must follow the rules of the policy. The surrender value is the investment portion of your cover less any penalty fess and other fees.

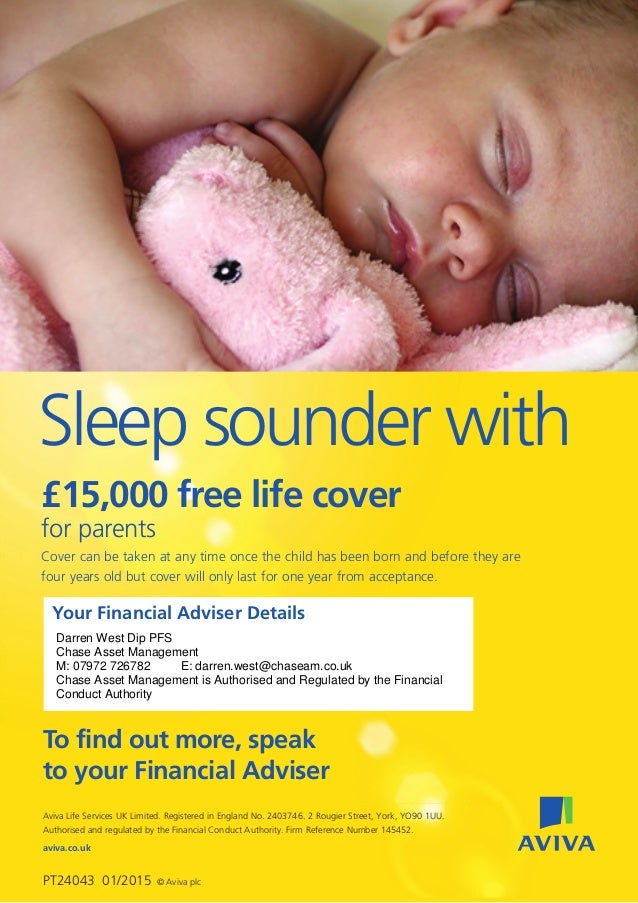

This will consider the possibility that your parents still have several years ahead of them should they be in good health. Our free parent life cover offers each parent 15000 worth of life insurance for free as a first step towards protecting their family. Your individual circumstances will affect your answer. If they dont have a policy yet you can open up a new one on their behalf.

What this implies is that if you take up cover for your parents and then later decide that you do not want to continue with the policy it will automatically lapse without any money paid to you in a term policy whereas you will receive a surrender value determined by the insurer in a whole policy. Term life insurance is sufficient for most people but if your parents have a higher risk tolerance and want to treat their policy as more of an investment permanent life insurance might be a better fit. If your parents are over 70 the best life cover option to go for is a whole life option. You can take out free parent life cover for children aged 0 4.

Premiums are likely to be higher though. Life cover for parents over 75 in south africa. So should you take out life insurance on your parents lives. By taking life insurance out on your parents you can protect yourself against financial hardship should they pass away.

This type of life insurance is a comprehensive policy that offers a guaranteed payout that covers your parents for their entire life. At 1life the life assured must be younger than 65 years to qualify for life cover. For example life insurance will not pay a claim if it is found the life assured or policy owner were taking part in criminal activities.